There are a lot of different ways people invest, trade or speculate in the financial markets. Some speculate on price movements within the timeframe of minutes or within a day and will close all their positions at the end of the day in order to sleep well at night and have no worries about what the markets will do while they are not behind their monitors watching the markets. Others invest long-term and tend to strategically hold on to their investments, even when bad times hit. They believe that they in the end will see the intrinsic value of that asset return with an upside potential.

I am not one of these long-term-hold-on-strong-and-sit-tight type of traders. I cannot understand why I would want to hold on to something when its value starts to fade away, only in the hope that on the long run its value will return and possibly continue on in the right direction. Why not just sell off that asset for now to buy it back when you see potential for it on its way up again? Or why not follow the money flow in the financial markets and put your money there where you can get better returns? Assets of all classes fall in value for shorter or longer times and sometimes contrair to what the fundamental value of the asset would suggest. The art as I see it is in seeing the money flow in the financial markets from one asset class to another on a minute to minute and daily basis. Then as you start to understand why money flows out of certain asses classes into others, you have a good starting point before you consider possible trades.

Risk-On or Risk-Off Sentiment

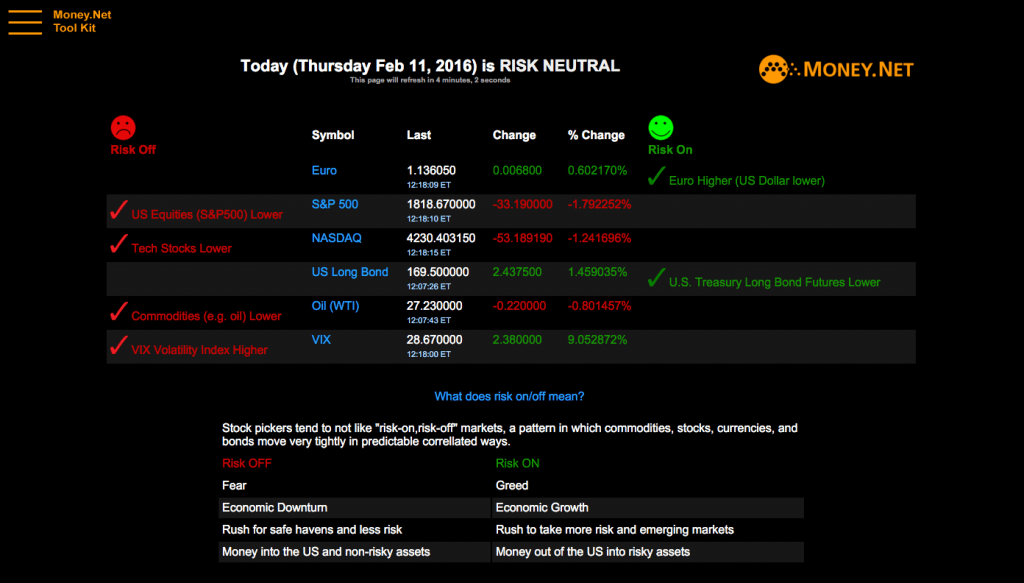

What is basically happening in the financial markets is, that money goes there where it renders the best gain or where it is safe in times of trouble. It is the fear and greed mechanism that is at work. If overall investors, bankers, fund-managers and speculators have faith in the future and in the economy at large, you see money flowing to investments and asset classes that give a good return, but are also perceived as having more risks involved with them. Commodities and Equities (stocks) are commonly considered examples of such “Risk-On” asset-classes. On the other hand, when the market sentiment is “Risk-Off,” people are pessimistic about the economic outlook. In such “Risk-Off” situations, such a sentiment then leads to a run to safe havens. The money is taken out of the higher rendering risk asset-classes and put into lower rendering but safe havens such as e.g. Gold, bonds or the Japanese Yen currency. Figure out the general sentiment in the market and you are on your way to find out where at that moment you can best put your money or what to trade on. In some situations, it is even best to close out all your open positions and keep your money out of the markets until new opportunities arise. Once you get again a clear picture of the direction of flow of the money in the markets from one asset-class to the other and of the general market sentiment you can again consider possible moves. By leveraging this knowledge, you can increase the return on your trades and investments. Instead of investing in only one asset-class such as equities and leaving the money in there, you could consider moving the money with the flow of money in the market. If you take “Risk-On” and “Risk-Off” sentiments into account, you get a good head start to potential trade setups.

Trading Forex

Trading Forex has become popular. One of the reasons so many Forex traders fail is that they trade in a vacuum with no knowledge or awareness of related markets or how these markets might be related or have an effect on each other. The currency market sits at the heart of all the markets and is the only market where a currency can be bought and sold against a huge range of other currencies. If you would compare this to trading e.g. stocks, all the buying and selling is done through that single instrument. Not so in the currency market. For example, it a large bank wants to trade in Euro, it can simply sell US dollars to buy Euro which is a straight forward buy of the EUR/USD. But, if the trade was significant, it might decide to buy or sell first against another currency and then to sell that currency against the Euro , thereby hiding the true nature of the buying and selling from view. It is dead easy to open a forex account with an online broker and making money in Forex is theoretically just a matter of guessing right in which direction (higher or lower) a currency-pair exchange rate will move. If you were right, you make some money. If you were wrong, you loose some. In reality it is not that simple.

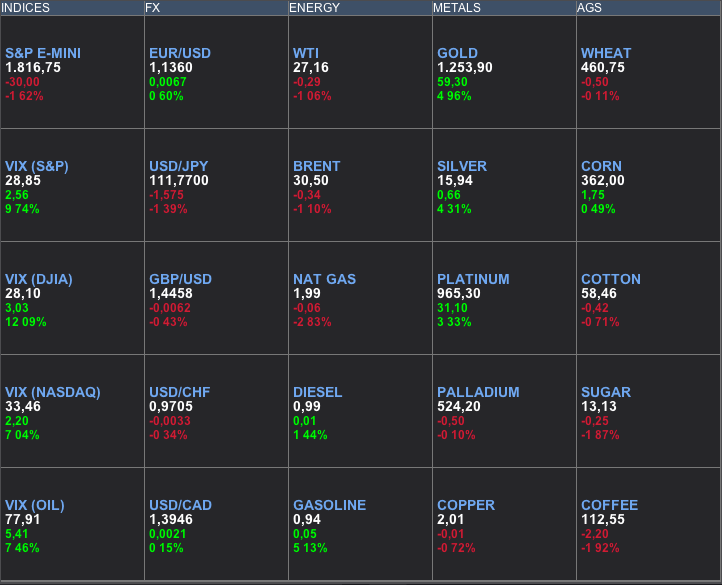

If however, you would have a good fundamental view on the general market sentiment in other related markets such as commodities, equities, bonds and futures before considering a possible Forex trade, you give yourself a huge head-start to begin with. All these markets are intertwined. Find out how the money flows from one market to the other. Figure out what makes these markets move. Learn to understand how changes in e.g. the commodities market have an effect on currencies like the USD (most commodities are traded in US dollar) or on commodities related currencies such as the Canadian (CAD), Australian (AUD) or New Zealand Dollar (NZD) and visa versa.

Markets move on sentiment. Sentiment comes from fear and greed and the desire to either protect your assets in bad times or to increase its yield in better times. It is this knowledge of the overall market and money flow into and out of the asset classes that then reduces the risk of any trade you take. With this holistic view, trading becomes stress free as each trading opportunity is then based on this complete view of the market, the money flow and the risk and rewards. Understand the money flow, and you will begin to understand market behaviour in all of its forms.

The Main Market Components

The main market components at play are:

- Bonds

- Commodities

- Equities

- Currencies

Bonds are generally conceived to be a safe haven in times of uncertainties and financial turmoil. Commodities and equities are considered “Risk On” classes, with the exception of one unique commodity called gold, which is still considered the ultimate safe haven in times of trouble. Commodities provide us with a real world view of the relationship of money and real goods (the commodities). An economy that is primarily based on selling commodities sells its raw assets overseas in return for money. Equities are considered a “Risk On” or high risk asset class, while bonds are considered to be low risk but therefore coming with more conservative returns. Currencies play a unique role where one currency can be considered a safe haven currency such as the Japanese Yen, while others not.

As market sentiment changes due to news coming out that effects the markets, money flows in and out of one asset class into another. A holistic view of the financial overall market can provide you with a good basis for further fundamental and/or technical analysis which all together completes the picture. Get a feeling for market sentiment and use this knowledge to your advantage as with this information in your hand, you have a head-start when you consider possible trades in the Forex market.

Further reading:

A Three Dimensional Approach to Forex Trading by Anna Coulling book.

Risk On Risk Off Investopedia definition.